The days of being able to hand write your employees' pay-stub-generator.com are long gone as this takes far too long for many business payroll departments to take care of. Another problem is that the sum of information which goes on the ordinary pay-stub-generator.com is far more complex than it had been even a couple of short years ago. With most companies now handling all their financing including payroll on a computer the best reply to this is that the use of pay-stub-generator.com software.

Why Should I Use Software to Produce pay-stub-generator.com?

There are many different reasons why you ought to be using some kind of software to make pay-stub-generator.com via your payroll department. The most obvious thing is that integrating this type of software in your system will save your payroll section both time and effort each time payday comes about. In case you have a relatively large staff it can take hours for your payroll clerk to sit down and calculate each employee's hours, taxes, deductions and any other miscellaneous calculations that have to be made in order to allow them to fill out pay-stub-generator.com.

When your payroll staff has access to the perfect type of software they should simply need to select the employee from a drop down list, enter the correct number of regular and overtime hours they've worked and let the software go to work. The superior software will integrate seamlessly with your current accounting software so that when the pay-stub-generator.com is filled out both it and a paycheck can be printed. The money should then be deducted from the proper account.

What Information Should the Software I use to pay-stub-generator.com Include?

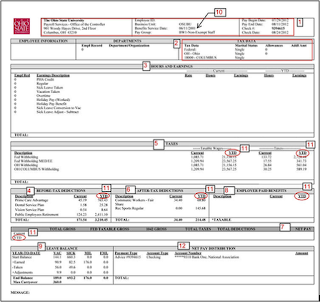

Where once a simple statement of how much your employees have earned and how much they got to keep may have been enough, this simply won't do anymore. Most employees are very concerned with knowing just how much they are paying in taxes and deductions. Not only do your employees wish to know but under certain laws, they have a right to know what is being taken out of their checks each pay period.

This information should include but is not restricted to federal taxes, state and local taxes as applicable and obviously social security and Medicare deductions. Most software used to pay-stub-generator.com now has lines included for showing deductions like health insurance payments, health savings account deductions, union dues and any miscellaneous deductions such as payments to a company shop. There also must be places to include info regarding the employee like name, address, and social security number.

When you're shopping for software to pay-stub-generator.com your best choice is to try several different versions until you find the one that is going to mesh with your accounting software and supply the clearest and most concise pay-stub-generator.com feasible for your employees.